Pay School Fees Online EON PH

Theoretically, this means that two grandparents could together contribute £6,000 towards school fees and avoid paying inheritance tax. This is true even if you pass away within 7 years of giving the gift. It's also worth knowing that you can carry forward unused annual exemption to the next tax year.

How you can instantly pay school fees using Airtel Money School Pay. YouTube

Where grandparents make such payments, it is important to consider the potential implications in respect of inheritance tax.Section 1 of the Inheritance Tax Act 1984 (IHTA 1984) provides that inheritance tax is charged on the value transferred by a chargeable transfer. IHTA 1984, s 2 provides that a chargeable transfer is a transfer of value that is not an exempt transfer.

The Education Department As Joblessness Leaves Parents Struggling To Pay School FeesBAD NEWS

Fast forward to 2023 and Civitas reports that today's parents are looking at secondary day school feels of around £16,654, based on 2022 data. Meanwhile, the average salary for higher earners has risen to £72,000 - so school feels now represent 23.1% of gross income, or around a quarter. And if you include boarding fees, this roughly.

Blog Highschool Cube

Writing a note to grandchildren that you are paying their fees can later be used as evidence to show the grandparents have not dipped into capital to maintain their own standard of living. IHT allowance. Reducing capital can have IHT advantages as well. Gifts that total up to £3,000 in each tax year are within the annual IHT allowance.

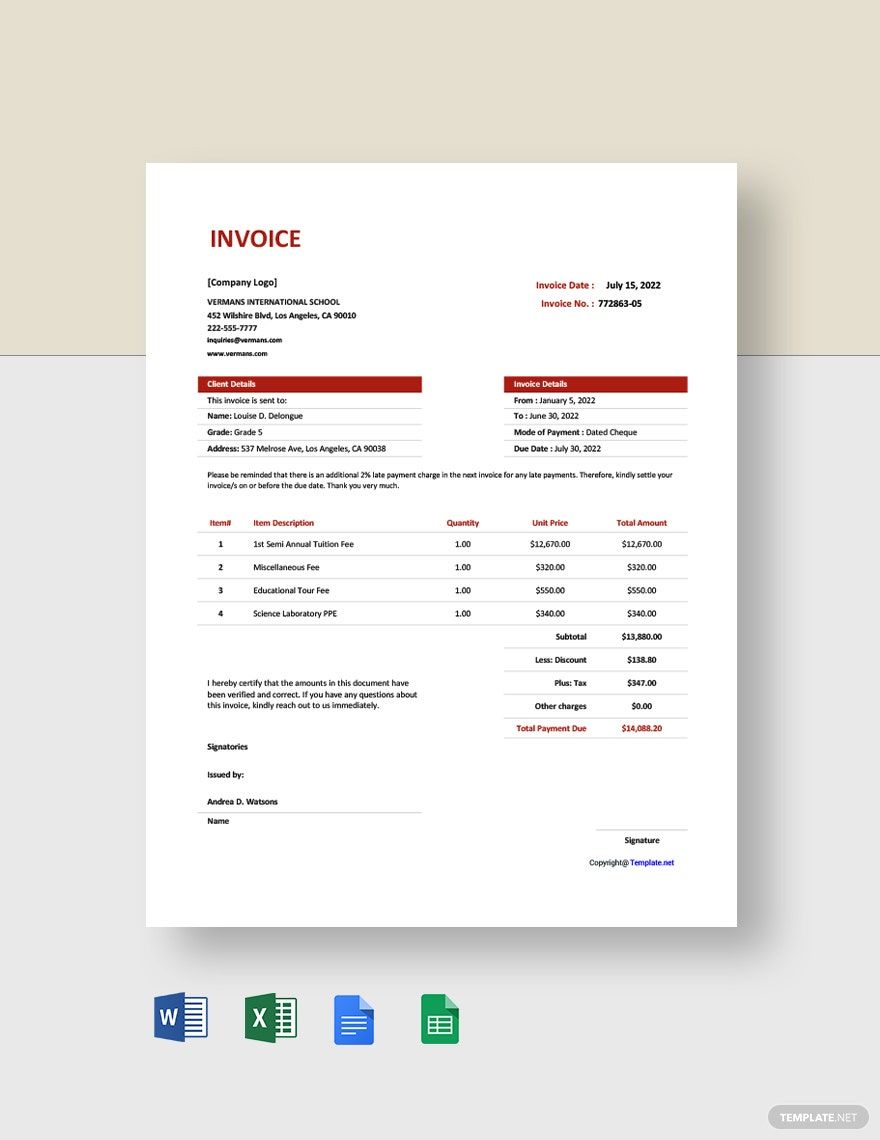

Explore Our Image of Law Firm Invoice Template Invoice template word, Invoice template, Home

HMRC allows each individual to give away £3,000 each tax year without these having any tax consequences. The £3,000 is known as an 'annual exemption' and can be given to one person or split between several people. While this annual exemption is relatively small compared to the annual cost of private school fees, it is an available.

browse our image of school donation receipt template receipt template school fees school

After 7 years, the funds set aside by the grandparent will generally pass outside of the estate for inheritance tax, saving up to 40% of the amount put into trust, maximising the amount available for school fee payments. For example, on a gift of £325,000 into trust, the saving could be £130,000 after 7 years. Our expert advisors work with.

Want to Run for Student Government Next Year? Timpview High School

As mentioned, your child has two options: They can transfer the unused portion of their tuition credit or carry it forward. If they choose to transfer the credit, they can transfer up to $5,000 less the amount used to reduce tax owing. So if they reduced their tax by $1,000, the most that can be transferred is $4,000.

How Tax Savvy Grandparents Can Help Fund Private School Fees For Your Children FV Tax

If we take an average day school pupil of fees of £10,000 per year, over a 13-year education for the child, that would be over £130,000. If you've got three children, that's £390,000. To pay fees of £10,000 per year, for a top rate taxpayer can mean extracting over £16,000 from the family business to leave them with the £10,000 after.

How Tax Savvy Grandparents Can Help Fund Private School Fees For Your Children FV Tax

That is £12,000 which could be jointly gifted by grandparents to assist with educational costs, if they have made no previous gifts in the last two tax years. A potential Inheritance tax saving of £4,800. Grandparents can also assist by making regular gifts out of their surplus income, providing that they can show that such gifts will not.

How to Pay School Fees Digitally YouTube

Tuition fees are currently set at £9,000 per year and an average maintenance grant is £3,575 per year. If a salary of £25,000 per year is secured after leaving university the student loan can be paid off within 23 years and 11 months. This on top of ever increasing cost of living may mean that parents and grandparents may consider.

Grandparents Pay For IVF Treatment YouTube

Tax efficient ways for grandparents to contribute to school fees. 31st May 2022. The average annual cost of private school fees in 2022 in England and Wales was assessed by the Independent Schools Council to be £14,940 for day pupils and more than double that for boarders. It's not surprising that many parents who feel that private education.

Grandparents Paying for College? Read This First Retirement community, Retirement, College tuition

Grandparents can place assets into trust worth up to £325,000, and they will be free of IHT so long as they survive seven years after the gift was made. However, the added benefit of funding school fees in this way is that the income generated by the trust will be taxed at the beneficiary's rate of tax - that is the child's.

SNP’s new auditors linked to school fees tax scheme AccountingWEB

1. Pay tuition directly. Grandparents can pay some or all of the cost of tuition directly to the school, and the amount generally will not be subject to gift tax nor will it count toward the.

How to Pay Tuition Fees without Student Finance Acrosophy

How inheritance tax works. According to the government's website, in the tax year 2020/21, IHT is levied at 40% on the value of your estate above your £325,000 exemption, known as the nil rate band. This rises to £500,000 if you own your own home and leave it to your children or grandchildren, this is known as the main residence nil-rate band.

Simple School Invoice Template in Google Sheets, Google Docs, Excel, Word, Pages Download

Back Family finance Tax-free childcare UK:. can be for anything, but school fees are a good example of something which could constitute a regular payment. A one-off payment of school fees would.

Dealing With School Fee Exemptions Innovation Advance

Trusts used for the payment of school fees would usually be discretionary in form. What this means is that trustees would be given the discretion to decide who, when and how a beneficiary benefits from a trust. The class of beneficiaries could include children and grandchildren. For example, the settlors could settle a rental property on trust.